10Y Review of the Bulgarian Residential Real Estate Market 2000-2010

With the end of the first decade of the new century, during which we witnessed the beginning of a modern real estate market in Bulgaria, we from BULGARIAN PROPERTIES decided to turn back and make an overview and to strike a balance of the existing data of the properties in Bulgaria in the last ten years.

With the end of the first decade of the new century, during which we witnessed the beginning of a modern real estate market in Bulgaria, we from BULGARIAN PROPERTIES decided to turn back and make an overview and to strike a balance of the existing data of the properties in Bulgaria in the last ten years.

We witnessed a very dynamic ten years in the Bulgarian property sector which brought about drastic increase in prices and in the number of deals, as well as more dynamism to the building sector followed by a plummeting in the last two years.

We used the data of the National Statistical Institute (NSI) as a basis for our research, it being the most comprehensive existing statistics of property prices. This information is relative only to residential properties – apartments in regional cities around the country. Even though it doesn’t include holiday properties, rural houses, plots of land and commercial properties it is comprehensive enough to show the main market trends and the directions in which the market developed. The housing fund data and the issued building permits also come from the NSI, and the data about the number of sales come from the Registry Agency. All calculations, data transformation and graphs were made by the Property Market Analyses and Forecasts Unit of BULGARIAN PROPERTIES.

The main highlights of the analysis are as follows:

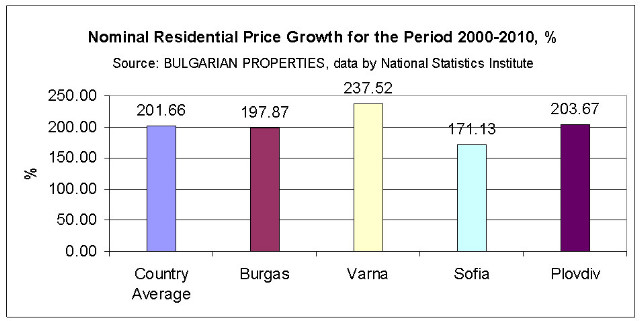

• Accumulated nominal increase of average prices of apartments in the regional cities for the last 10 years - 201.66%; for Sofia and Varna the increase is 171.13% and 237.53% respectively;

• Accumulated nominal decrease of prices compared to the peak values in the third quarter of 2008 until the last quarter of 2010 - 33.31% on average for the country, for Sofia - 36.6%;

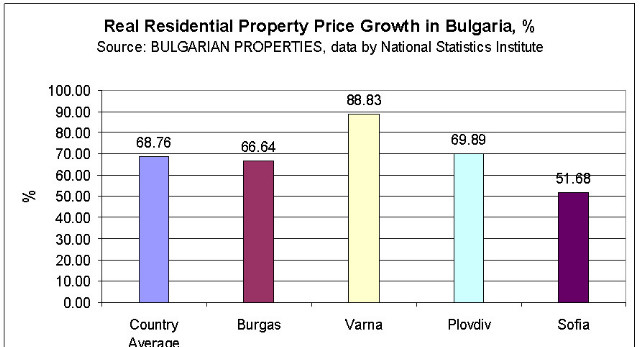

• Accumulated real increase (after deducting inflation) of prices of apartments in the regional cities in the last 10 years +68.76%; for Sofia and Varna the increase is 51.68% and 88.83% respectively;

• Accumulated real decrease (after deducting inflation) compared to the peak values in the third quarter of 2008 until the last quarter of 2010 - 36.6%; for Sofia - 39.7%;

• Average annual appreciation of the residential apartments in Bulgaria in the past 10 years +11.65%; for Sofia and Varna +10.48% and +12.95% respectively;

• Decrease in the number of property sales in the regional cities by 54% compared to the peak value in 2007;

• Decrease in the number of issued permits for building new residential buildings compared to its peak in 2007 by 56%;

• 3.94% increase in the number of residential units in the cities in the period 2004 – 2009; in Sofia the increase is by 2.59% and in Varna by 7.72%.

I. Average prices and increase of home prices through the years

- nominal growth

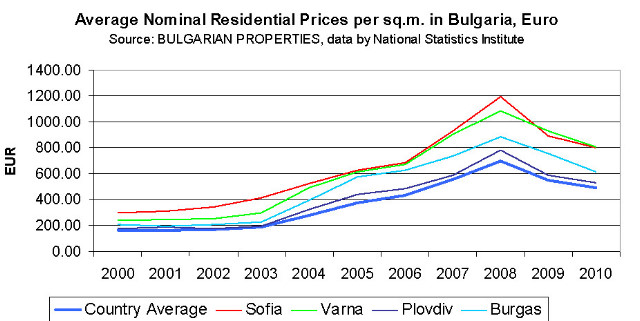

In the period 2000-2008 prices of apartments continuously increased as the peak in their value was reached in the third quarter of 2008 followed by a plummeting in the number of deals and in property prices in the next 2 years. The highest prices of apartments were reached in Sofia and Varna, as in Varna the price decrease was more gradual and at the moment the price per sq.m. in the two biggest cities in the country is almost the same – the average price per sq.m. in Sofia in 2010 (802 EUR) is only about 5 EUR lower than that in Varna (807 EUR). The accumulated nominal decrease of property prices from the peak in the third quarter of 2008 until the last quarter of 2010 is 33.31% on average for the country and 36.6% for the capital Sofia.

Average prices of apartments around the country registered a nominal increase of 201.66% in the last 10 years. The average annual appreciation of apartment prices in the country in the past 10 years is 11.65% which shows that even after the big price drop in the last 2 years investing in a residential property is a sound investment in the long run. What is important is to decide at which point of the market cycle is best to buy a property and how long to keep the property before selling it so it is liquid; it is quality properties that are liquid and investing in is such properties is the best choice.

The leader in terms of price increase among the big cities is Varna – with 237.52%, as the price increase in Sofia is below the average for the country – 171.13%. The average annual appreciation of apartment prices in Sofia and Varna is 10.48% and 12.95% respectively.

The towns with the biggest increase in property prices in the last 10 years are as follows:

• Silistra – 330.94%

• Targovishte – 310.48%

• Kardzhali – 309.28%

An explanation for the big price increase in these towns should be sought in the fact that prices of properties there were very low in 2000 – starting from about 77 EUR/sq.m. and in the next years they compensated with a bigger increase in order to catch up with the average prices around the country.

- real price increase

When talking about increase in prices we should also take into consideration the inflation. That is why we deflate current property prices with the harmonized index of consumer prices (HICP) in order to follow the real increase of property prices. Here is the data after deducting the inflation.

On average, prices of apartments around the country increased by 68.76% for the period 2000 – 2010. Even after the price drop we have a positive real increase in their value.

The biggest real increase is to be found in Varna – 88.83% and for Sofia this increase is 51.68%. The accumulated real decrease in prices after deducting inflation starting from the price peak in the third quarter of 2008 until the last quarter of 2010 is 36.6% (on average for the country) and for Sofia it is 39.7%.

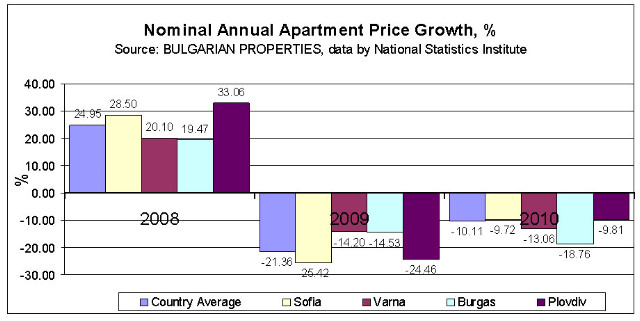

Annual price growth of residential apartments

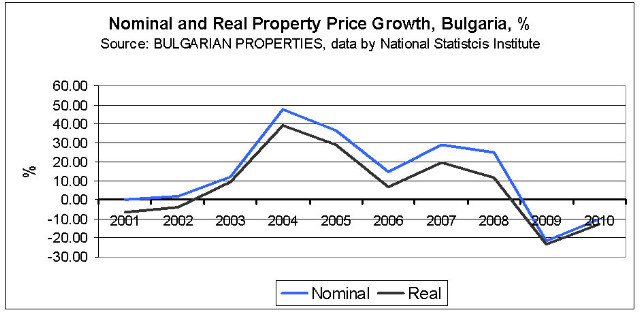

From a zero increase in the beginning of the decade (even reporting a decrease after deducting inflation), 2003 saw a two-digit increase of the prices year-on-year, which reached its peak value in 2004 - 47.48% nominally and 38.94% after deducting the inflation. In 2005 the increase continued to be considerable but in 2006 it slowed down to 14.7% nominally and 6.78% after deducting the inflation. This means that in 2006 there was a slowdown in the increase in apartment prices (there still was an increase but it was slower compared to the previous two years). In 2007 and 2008 the nominal price increase returned to levels of over 20% - 28.91% (in 2007) and 24.95% (in 2008). In 2008 the inflation rate measured with the HICP was quite high (11.95%) and the real price increase was in fact only 11.61%.

What followed are two years of price decrease – of about 22% and 10% nominally in 2009 and 2010 respectively. The real decrease of apartment prices after deducting the inflation for these two years is 23.26% and 12.75% respectively. This means that although price decrease slowed down in 2010 the price growth is still in the negative zone of the graph. The trend of coming out of the negative and going to positive growth is obvious and our company forecast this growth to start at the end of 2011 if there are no economic shocks and there is positive economic development.

In 2009 it was the prices of apartments in Sofia that reacted fastest to the descending market trends, while prices in Varna and Burgas decreased by 10 p.p. less compared to those in the capital Sofia. However, in 2010 prices in Sofia stabilized and decreased by 10.11% year-on-year, while prices in Varna and Burgas decreased by 13.06% and 18.76% respectively. This shows that the market in Sofia is much more flexible and mature and sets the trends which the other cities follow with some delay.

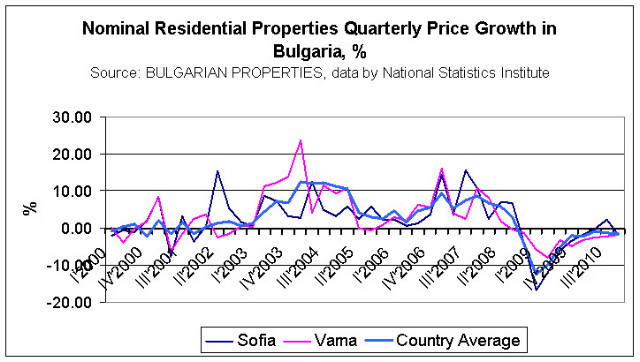

Quarterly property price growth

Compared to the previous quarter in 2010 the decrease is already under 5%, as prices of Sofia apartments even have a zero and positive growth in the 2Q and 3Q of 2010.

When we compare the data to the same quarter of the previous year we see a trend showing smaller and smaller decrease in prices starting from the 3Q 2010, as prices of apartments in Sofia once again show the smallest decrease compared to the general prices around the country and to those in Varna.

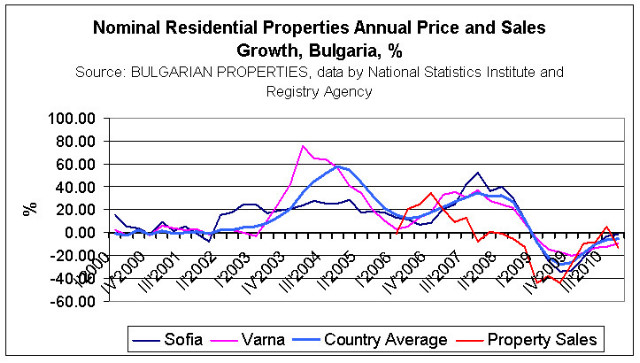

II. Number of property deals in the regional cities

Sales volumes are an extremely important indicator of the trends on the property market as they give early signals for weakening or strengthening of the market and therefore of property prices.

The highest number of sales was realized in 2007 after which in 2008 sales volumes decreased by 5.34% compared to the peak volumes in 2007; in 2009 the year-on-year decrease is -37.16% and in 2010 the decrease in the concluded deals in the regional cities slows down to -7.15%. The accumulated decrease in the sales volumes in the regional cities compared to their peak in 2007 is -45%. This means that on the one hand we have a decrease in the sales volumes of 45% compared to their peak in 2007, and we have an accumulated actual decrease of apartment prices in regional cities of 36.6% compared to their peak in 2008 until 2010 on the other. This data shows the direct link between the sales volumes and property prices in Bulgaria and that it is the sales volumes that react first to the changes in the market trends and prices react later. In 2011 we expect the sales volumes to start increasing which will be one of the first indicators for coming out of the crisis.

Copyright: 2011 Bulgarian Properties Ltd. All rights reserved. For further information or advice please contact us on tel.: +359 2 9 11 50 or e-mail: info@bulgarianproperties.com. The use of this article by third parties is allowed only with proper quotations of the source www.BulgarianProperties.com and the Author of the article. The data in this material has been collected by the Author and Bulgarian Properties Ltd. and is presented for information purposes only. We have made every effort to ensure the accuracy of the data. However, Bulgarian Properties Ltd. cannot be held responsible for loss or damage as a result of decisions made based on the information presented in this article.

© Bulgarian Properties Ltd. 2011.